Australia’s remarkable v-shaped recovery from Covid-19

It has been a year since the first Covid-19 lockdown where borders were closed and many people were forced to work from home. There was a big drop in share market values and questions were being asked by investors about how long it would take for things to recover.

Below I share with you an article written by Deloitte Access Economics which succinctly answers that question one year on…

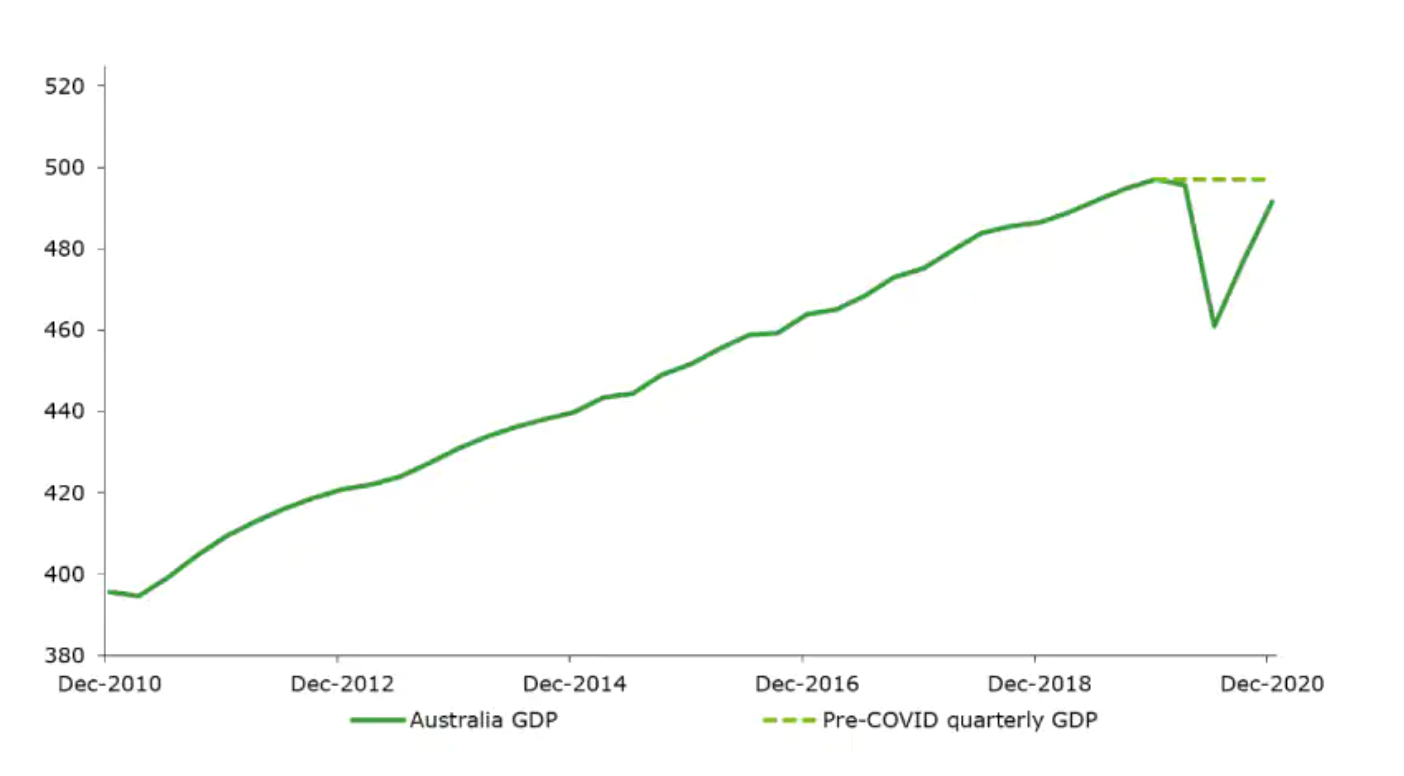

The recent National Accounts release by the ABS showed that Australia continued its impressive V-shaped recovery in the December 2020 quarter, with GDP rebounding 3.1%.

This increase is further evidence of momentum in the Australian economy and adds on to 3.4% growth in the September quarter, when most parts of the country emerged from lockdown.

However, we’re not quite at pre-COVID GDP levels yet. Indeed, the ABS release revealed that December’s Gross Domestic Product (GDP) was 1.1% lower than in the same quarter of 2019.

Chart 1: Australia quarterly Gross Domestic Product, billions

Source: ABS National Accounts

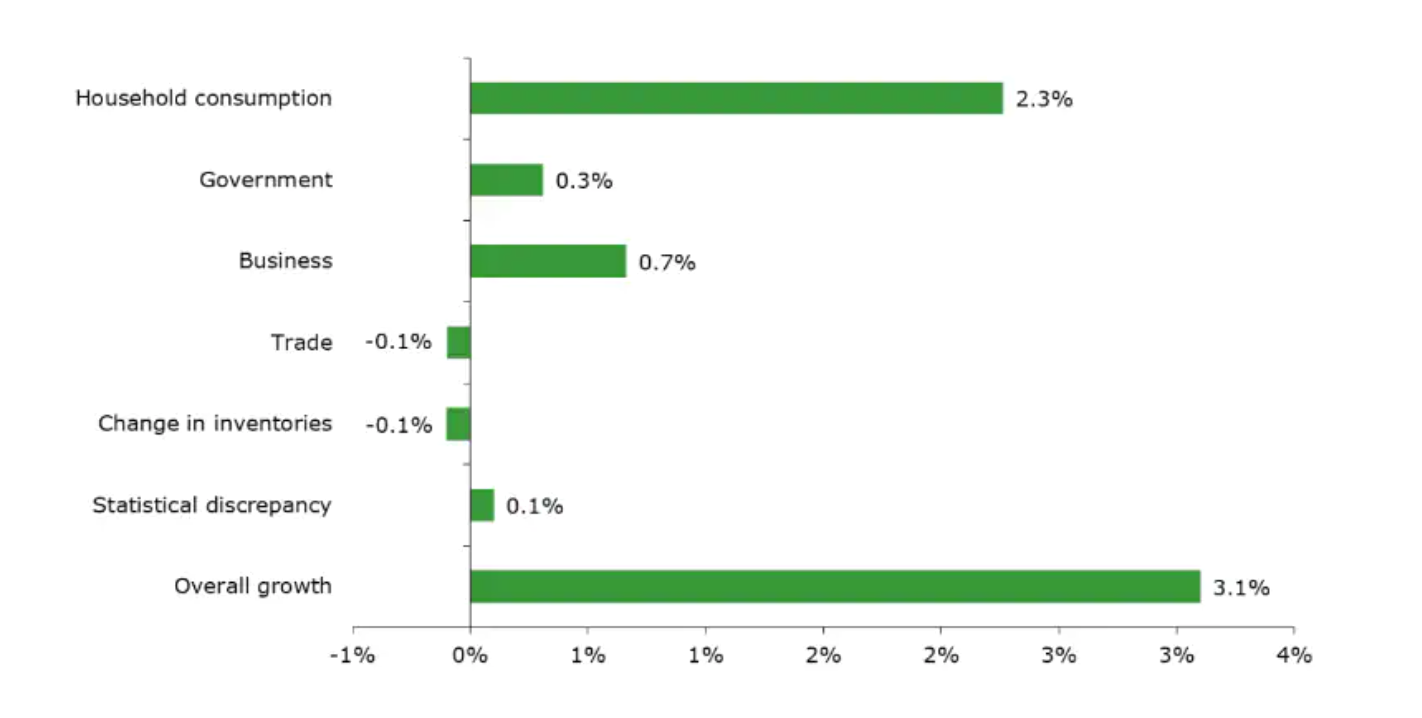

Nonetheless, Australia’s recovery has been outstanding thus far and ranks amongst the best in the world. Additionally, households continue to play an instrumental role, with consumer spending by far the biggest driver of GDP growth in December.

This was led by Victoria’s emergence from stage four lockdown. As restrictions were eased, Victorian consumer confidence picked up, with Victorian consumer spending bouncing back by 10.4% from its depths.

Yet households all over the country contributed, with NSW, QLD, TAS, NT and the ACT all experiencing consumer spending growth at or above 2.3%. On the one hand, extensions to JobKeeper and the COVID supplement, as well as other Federal and State Government stimulus, are adding fuel to the Australian economy. Concurrently, for a nation that owed the world a trillion dollars before the pandemic, lower interest rates have been a major cost cut.

The result: an incredible rebound in real national income, up 2.1% on pre-pandemic levels, after falling almost 8% in June. Undoubtedly, consumer spending has been a massive benefactor, providing critical assistance to car dealers (vehicle purchases rose 31.8%), retailers, hotels, cafes and restaurants, especially in regional areas. Similarly, increased movement, within and across states, as well as a fall in the national savings rate, which dropped from 18.7% to 12.0%, provided much needed support.

Second to consumer spending, private business investment jumped 3.9% during the December quarter. As business confidence improved, investment is starting to follow, with machinery and equipment spending rising 8.9%. At the same time, HomeBuilder and other policies have helped to drive incredible demand for property and new homes, with dwelling investment rising 4.1%.

On the trade front, exports grew 3.8% in December (boosted by a bumper grain harvest and strong LNG, coal and gold exports), while imports jumped 4.9% (buoyed by a sharp rise in capital and consumption goods). With imports growing faster than exports, trade detracted 0.1pp to growth this quarter.

Conversely, government spending was a positive contributor to growth. Public investment rose 2.5% on the back of strong defence capex, while public consumption lifted 0.8%.

Chart 2: Contribution to economic growth, December 2020

Source: ABS National Accounts

Thanks for the information